We have been living for almost a year now a very anxiety-provoking time due to the Covid-19 health crisis. This crisis, as well sanitary as economic, has significantly accelerated the demand for digital transformation at a global level.

After their last study published in October 2020, Oracle & Workplace Intelligence Global Survey on AI at Work , Oracle publishes now a new study just as outstanding, in the sense of a better understanding of the confidence we have in AI and more particularly here in the field of Fintech. This study is all the more interesting from my point of view because it also induces that the reduction of biases in artificial intelligence algorithms must be so, more and more a priority in our new digital era under construction.

Let’s take a closer look at the results of this Oracle + Savanta + Farnoosh Torabi Global Study/Survey on AI and Finances, with an highlight on these four important points:

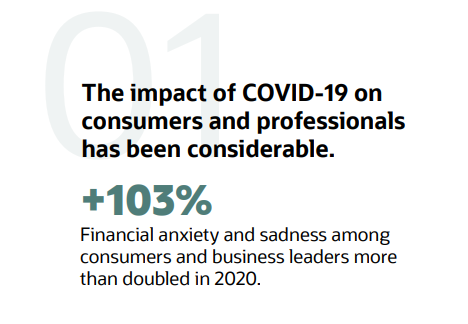

- 1- COVID-19 has created financial anxiety, sadness and fear among consumers and business leaders

Set the stage by explaining how COVID-19 has negatively impacted our relationship with money at home and at work: Financial anxiety and sadness among consumers and business leaders across the world more than doubled (increased by 103%) in 2020

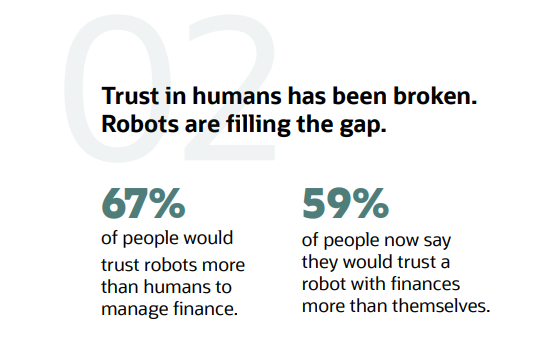

- 2- Our trust in ourselves is broken; we now trust robots more than ourselves to manage business and personal finances

Highlight how our evolving relationship with money has changed who we trust to manage our finances; provide headline stat/attention grabber with “67% of People Trust Robots More Than Humans to Manage Finances”

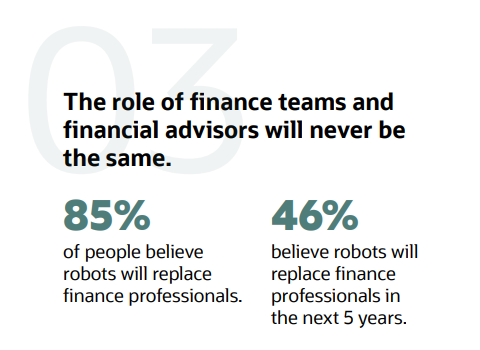

- 3 – The role of finance teams/professionals and personal finance advisors will never be the same again

Underline the need for finance teams/professionals and personal finance advisors to embrace tech-driven change by highlighting people’s belief that robots will replace them within the next decade: 85% of people believe robots will replace finance professionals in the next five years; 46% of consumers believe robots will replace personal finance advisors in the next 5 years.

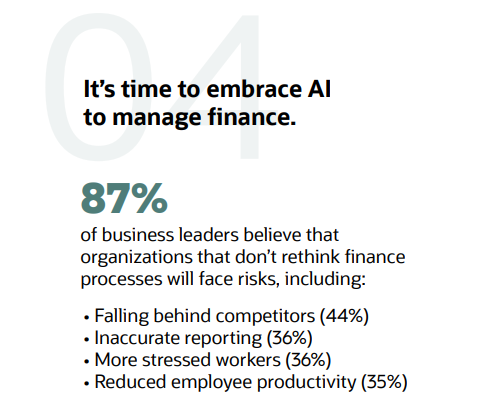

- 4 – Our relationship with money has changed. It’s time to embrace AI to manage finance

Create a call to action for organizations to rethink finance related tasks and the ways they enable consumers to buy goods and services: 87% of business leaders believe that organizations that don’t rethink finance processes will face risks; 60% of consumers say the pandemic has changed the way they buy goods and services

To learn more about this global study, feel free to click here : Money and Machines: 2021 Global Study

___________________________________________________________________ Special thanks to Bastien Rousseau for his precious help for this article. Infographic courtesy of Oracle

![The Incredible Growth of Fintech [Infographic]](http://ipfconline.fr/blog/wp-content/uploads/2018/02/31-01-2018-growth-of-fintech-1-218x150.jpg)

![FINE LIST OF 50 TOP WORLD BIG DATA EXPERTS TO FOLLOW IN 2017 [WITH MOZ SOCIAL SCORE]](http://ipfconline.fr/blog/wp-content/uploads/2017/05/Capture0000001ALTERN-218x150.jpg)

![FINE LIST OF 30 TOP WORLD INSURTECH EXPERTS TO FOLLOW IN 2017 [WITH MOZ SOCIAL SCORE]](http://ipfconline.fr/blog/wp-content/uploads/2017/05/hgfhfh1-218x150.jpg)

Really nailed it through this post. loving the way you have shared the info here